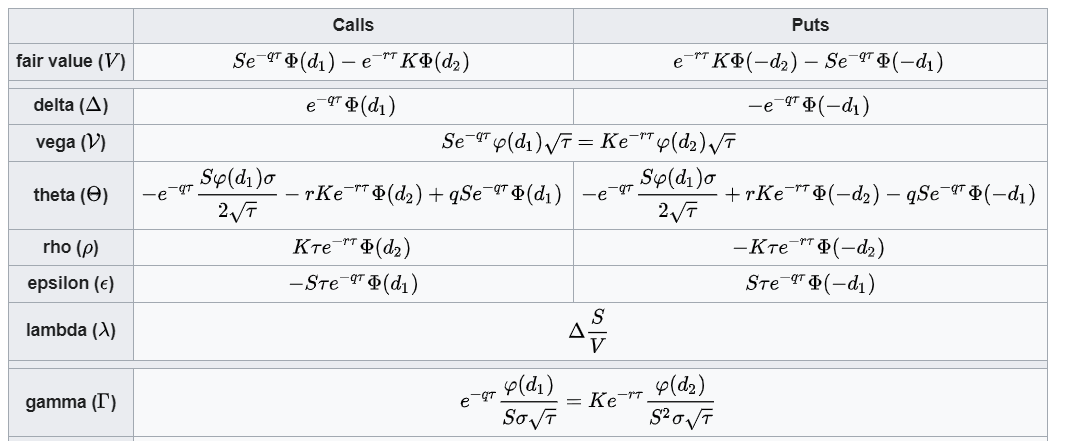

for sigma in sigmas:

plt.plot(spot, opt_dict[f"call_{100*sigma}"], label=f"Call at {100*sigma}% vol")

plt.plot(spot, intrinsic_value, "k--", label="Intrinsic Value")

plt.title("Call price as a function of the underlying price")

plt.xlabel("Spot price")

plt.ylabel("Call price")

plt.legend();